Are you ready for changes to Long Service Leave in the Community Services Sector?

In June 2024, the NSW Parliament assented to the Community Services Sector (Portable Long Service Leave) Act 2024 (the Act) which is due to commence on 1 July 2025. The Act creates a long service leave scheme in NSW (Scheme) for employees in the Community Services Sector (CSS).

Why was the Scheme introduced?

The legislation was created to facilitate CSS workers obtaining access to long service leave. As you may be aware, the CSS is made up of approximately 250,000 workers (of which 75% are women) across 7,300 service providers.1 In the past the CSS has relied on short term government funding to run programs and other services. This means that workers are often employed on short-term contracts, as the funding for future programs is uncertain. As a result, workers often move between service providers or work for more than one service provider at a time. While employees may work in the CSS for decades, they often miss out on long service leave, because they are not employed by one organisation for long enough to receive their long service leave entitlement.

Unlike the entitlement to long service leave under the NSW Long Service Leave Act 1955 (LSL Act), which accumulates after ten years’ service with one employer, the Scheme allows employees to accrue long service leave across different jobs, employers and contracts in the CSS, thereby accumulating service for the purposes of long service leave. Similar schemes have been introduced in Victoria, Queensland, the Northern Territory and the ACT, and South Australia also introduced similar legislation in 2024.

Who does the Scheme apply to?

The Scheme applies to employers and full-time, part-time and casual employees in the CSS as listed in Schedule 1 of the Act and the table at the end of this article. In summary, it applies to most CSS workers but does not include some workers traditionally thought of as part of the sector including early childhood education and care workers, or health care services. It includes employers and organisations or individuals who supply workers through a labour hire arrangement to do community service work. The scheme does not apply to government organisations or their employees.

Contractors may also opt in to the legislation.

As an employer predominantly in the CSS, are my administrative staff also covered by the Act?

Yes. The scheme covers workers based on the fact that they either:

carry out CSS work; or

because they are employed by an organisation whose predominant purpose is to provide a community service.

If the predominant purpose of your organisation falls within the services prescribed by the Act, then administrative and other support staff will also be covered by the Act.

Who administers the scheme?

The scheme is administered by the Long Service Corporation (LSC) constituted under the Long Service Corporation Act 2010. The Act amends the Long Service Corporation Act requiring the Corporation to establish and administer the Community Services Sector Long Service Leave Fund.

Does my organisation have to register?

Yes, sections 10(2)(a) and (b) of the Act provide that all eligible employers in the CSS must register within one month of the legislation commencing. If the LSC accepts registration it provides each employer with a certificate of registration.

Do employees have to register?

An employee may register themselves, or their employer can register them. We recommend that employers register their employees, because if the employees do not do it within 3 months and 14 days of commencing community services work the employer has to register them anyway.

What is the entitlement to LSL under the Act?

A registered worker is entitled to:

6.1 weeks of long service leave after completing 2,555 days (7 years) or more of recognised service; and

0.8667 weeks of long service leave for each additional 365 days of recognised service (after the 7 years’ service.

Note: this is not retrospective, the service must be completed after the commencement of the Act and starts on the day the worker is registered.

As an incentive for employees to sign up to this new scheme, any worker who is registered within 6 months of the commencement of the Act, will be deemed to be a “Foundation worker” and will be credited with 365 days service.

The entitlement to leave is the same as the LSL Act however, employees may take the leave after 7 years (or six years if they are a Foundation worker).

What if an employee has a break in working in the Community Services sector?

Employees do not have to work continuously in the CSS to qualify for long service leave under the Act. In fact, they may have up to a four year break from the sector and still qualify for long service leave.

How are payments to workers under the Act funded?

The payments are funded through a quarterly levy which must be paid by all employers (and any contractors who have joined the scheme) to the LSC. The levy is based on a percentage of wages or remuneration. The government has not yet revealed the amount of the levy, however in the contract cleaning industry, which is covered by the Contract Cleaning Industry (Portable Long Service Leave Scheme) Act 2010, the levy is 1.7% of the ordinary wages paid to workers.

Can my employees receive payment and accrual of LSL under the Act and the LSL Act?

No. Section 30 of the Act states that an employee may only count a maximum of 365 days service per year under the Act and any corresponding legislation. Schedule 4, of the CSS Act also amends the LSL Act so that an employee is not entitled to a benefit under the LSL Act for a period for which the employee received a benefit under the Act. While it does not prevent employees from receiving a benefit under the LSL Act, the employee cannot claim both schemes for the same period.

If an employee takes long service leave under the Act, do we put them on leave without pay for this period?

No, you would put them on long service leave, the same as if they took long service leave under the LSL Act. The leave itself should be treated in the same way that LSL was.

If an employee has been with us for 10 years or more, would we still need to register them under the Act? If so, what if they have service under both the Act and the LSL Act?

Yes, you would still need to register them. Section 88 of the Act provides that if a worker has an entitlement to long service leave with an employer that accrued under the LSL Act, and they have not accrued an entitlement with an employer under the Act, the employer may apply to the LSC for reimbursement of the amount of long service leave payable to the employee for the period in which they were registered under the Act, but accrued an entitlement under the LSL Act [emphasis added]. For example:

if a worker has been with you for 9 years; and

you register under the scheme on 1 July 2025; and

the employee takes LSL on 1 July 2026, you will pay the employee for the 10 years’ accrued LSL, and you can apply to the Scheme for reimbursement of one year’s LSL entitlement (i.e. 0.8667 weeks’ pay) for the period in which the employee accrued leave under the LSL Act but was registered under the Act.

If an employee commences, could they take LSL within a short period of time?

This depends on the period of time in which the employee was working for another employer and how long the Act had been in place. As the provisions in the Act are not retrospective, it is unlikely that any employee will be in a position to take LSL under the Scheme for at least 6 years (that is if they are a foundation worker). However, subject to exceptions, once the Act commences, if a worker becomes entitled to LSL then an employer must grant LSL within 6 months after the day on which the worker became entitled to LSL.

Can employees take LSL one day at a time?

No, the minimum period of long service leave an employee may take is 2 weeks’ leave.

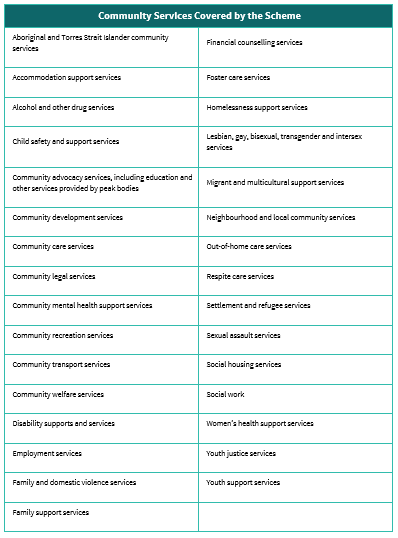

What Community Services are covered by the Scheme?

See table below.

The contents of this article are for informational purposes only and are current as at the date of publishing. They do not constitute legal advice and should not be relied upon as such. You may need to seek legal advice about your organisation’s specific circumstances. If you have any questions regarding the Early Childhood Education and Care Multi-Employer Agreement (Agreement), please contact us by email to enquiry@cer.catholic.org.au or by phone on 02 9189 5999.